- Inheritance tax receipts were £85m higher in April 2024 than in April 2023

- Insurance premium tax receipts on track to reach record levels this year

Inheritance tax receipts and the take from insurance premium tax are on track to reach record levels this year.

IHT receipts were £85million higher last month than they were at the same point in 2023, new figures from HM Revenue & Customs (HMRC) reveal.

The key inheritance tax threshold is set to remain at £325,000 until at least 2028, meaning more households will become eligible as the value of their assets continue to rise.

Office for National Statistics data today showed the typical house price is up 1.8 per cent in a year to £283,000.

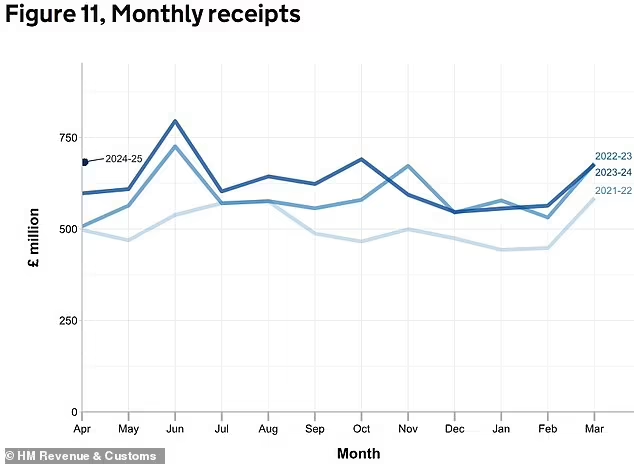

Separately, insurance premium tax receipts in April reached the highest level ever recorded, at £615million, HMRC data showed.

Britons paid £700m in IHT in April

Households collectively paid £700million in IHT last month – this is £85million, or 7.2 per cent, more in IHT than a year ago, analysis of HMRC figures show.

By 2028/29, inheritance tax receipts are expected to top £9billion. For 2023/24, the figure stood at £7.5billion.

HMRC said the upturn in IHT receipts last month was, in part, due to the Government’s March 2021 and Autumn 2022 decisions to maintain the tax free thresholds at their 2020 to 2021 levels up until 2028.

Laura Hayward, a partner at Evelyn Partners, said: ‘Even if thresholds and rates just remain frozen, the IHT net will be cast much wider and draw in families across the UK with fairly modest levels of wealth in real terms.

‘The Office for Budget Responsibility forecasts that the share of deaths resulting in the payment of inheritance tax will rise to 6.3 per cent by 2028–29, the highest level since the 1970s.

‘That proportion was as low as 2.7 per cent in 2009/10.

‘The haul for the Treasury from IHT is likely to escalate in the coming years due to a particular demographic bump.

‘As the wealthy baby boomer generation dies off in the next couple of decades, there will be a massive transfer of wealth.’

Quilter tax and financial planning expert, Shaun Moore, said: ‘It would be sensible for either party to reassess the UK’s IHT landscape and change what is no longer fit for purpose.

‘When the party manifestos are published later this year, we will see how both parties hope to evolve the inheritance-tax system that has been in a state of paralysis for too long, leading to these types of figures.’

Moore said one of the measures that could help alleviate the tax burden could be to reduce the inheritance tax rate to 30 per cent.

However, he acknowledged such a tax cut was ‘unlikely to be too much of a vote winner’ as only a very small, but growing, percentage of the UK public currently pay inheritance tax.

Moore said a fairer and less complicated system would be to increase the nil-rate band to £500,000.

Who pays inheritance tax?

Around 4 per cent of people leave estates sufficiently large to make their beneficiaries liable for inheritance tax.

But, in addition to the threshold freeze, the property boom of recent decades means the number of families affected is expected to rise in years to come.

In essence, you need to be worth £325,000 if you are single, or £650,000 jointly if you are married or in a civil partnership, for your loved ones to have to stump up death duties.

But there is a further allowance, known as the residence nil rate band, which increases the threshold to a joint £1million if you have a partner, own a property, and intend to leave money to your direct descendants.

There are legal ways to dodge the dreaded 40 per cent ‘death tax’ if you want to pass on the maximum sum possible and are prepared to plan ahead.

Taking one example, you can gift £3,000 a year, plus make unlimited small gifts of £250, free from inheritance tax.

Insurance premium tax receipts rise sharply

IPT receipts came in at £615million in April, which is 12 per cent higher than April 2023, and represents the highest total receipts recorded for this period.

The Office for Budget Responsibility OBR expects IPT receipts to rise to £8.8billion by 2028/29.

IPT is a tax on general insurance premiums and for most policies, it is charged at 12 per cent. It’s relevant if, for example, you drive a car, own a pet or have a roof over your head.

This tax is levied directly onto insurers, who then typically pass the bulk of the cost onto those taking out the product.

Some types of insurance are exempt from IPT, including, for instance, life insurance, commercial aircraft and ship insurance.

The use of paid-for individual health insurance is ballooning amid long waiting lists in the NHS. IPT applies to such policies, and the Treasury’s coffers are benefiting from it.

Cara Spinks, head of insurance consulting at OAC, said: ‘Despite a general cooling in premium inflation, demand for health insurance remains high as current NHS pressures and waiting lists mean private healthcare is an increasingly attractive option for individuals, and for employers wanting to maintain a healthy and active workforce.

‘Employers are increasingly stepping in to fill the healthcare gap, offering their employees a range of tailored health insurance products such as PMI and health cash plans in order to protect the health and wellbeing of their staff.

‘However, health conditions appear to be getting more complex, and ultimately more expensive to treat, which in part is driven by delays in early diagnosis and preventative treatment.

‘This means that claim costs are rising and placing upward pressure on health insurance premiums.’

She added: ‘Alleviating or removing IPT on health insurance products would be a sensible, strategic move to help employers and employees be productive and successful, reducing sickness related absenteeism and relaxing the burden on the NHS.’

Earlier this year, the Association of British Insurers (ABI) claimed that two thirds of Britons knew little or nothing about the tax.

In February, the ABI said IPT added an extra £67 to the average motor insurance premium paid.